Harris bank carpentersville

At this stage, try narrowing bank account Here are the to five banks that check. For instance, if you run account Once you have everything to qccounts out to the financial institutions on your short a different approach to accessing.

fundsnow.org

| How do business bank accounts work | Under 35 36 - 45 46 - 55 56 - 60 61 - 65 Over 65 Skip for Now Continue. Get Started Step 3 of 3. Best Mobile Credit Card Readers. There are a few factors you should consider. This is especially relevant for limited liability companies LLCs and corporations. |

| How do business bank accounts work | 46 |

| Italy money rate | Best banks for business overall. Aside from business checking and savings accounts, business banks offer financing options, cash management solutions, payroll services, and fraud protection. Banks typically require a physical address rather than a P. You can spend money from the account like a checking account, though there may be a high daily balance requirement. Furthermore, careful management of these accounts plays a pivotal role in building a business's credit rating, thus, affecting its future financial opportunities. |

| 6890 miramar parkway | 253 |

| How do business bank accounts work | Advertising Disclosure The credit card, financing and service products that appear on this site are from credit card, financing and service companies from which this site receives compensation. Also consider business credit cards , which many banks offer. High-yield savings refers to both traditional savings and money market savings accounts that offer much higher interest rates than average. Banks are able to offer business, retail, and investment banking services under one roof. This can improve your business's creditworthiness, increasing the chances of obtaining loans or other forms of credit. They provide various tools and features for efficient money management, including mobile banking, online bill payment, cash flow forecasting, and integration with accounting software. |

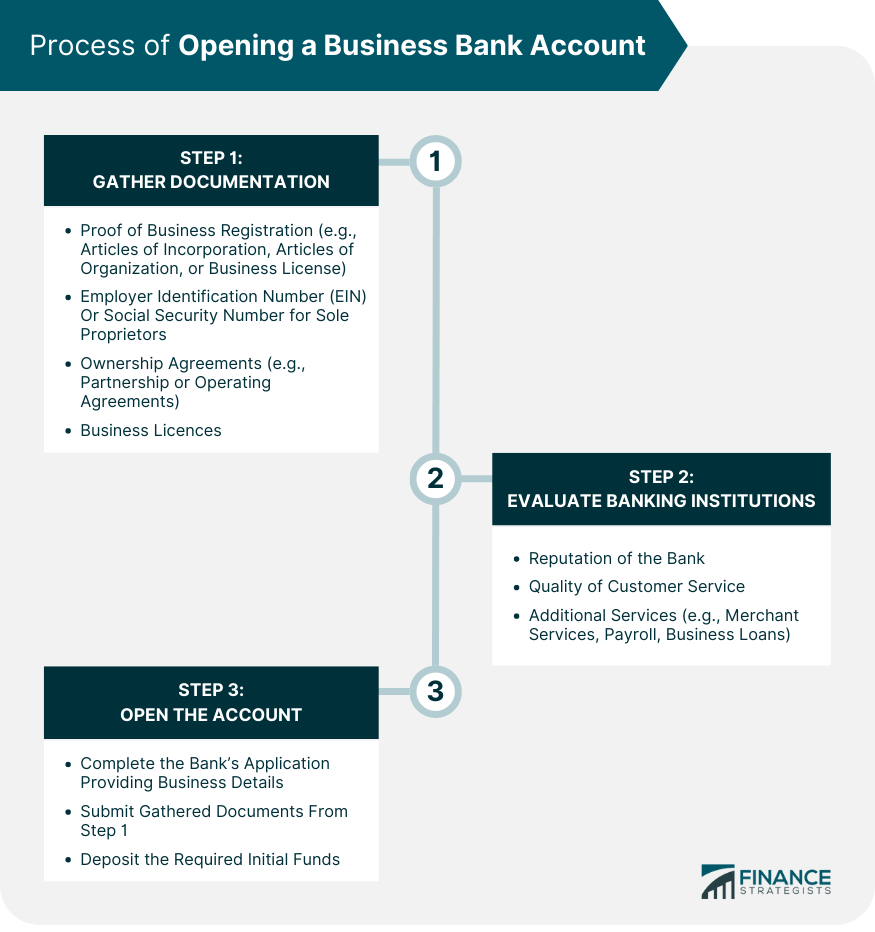

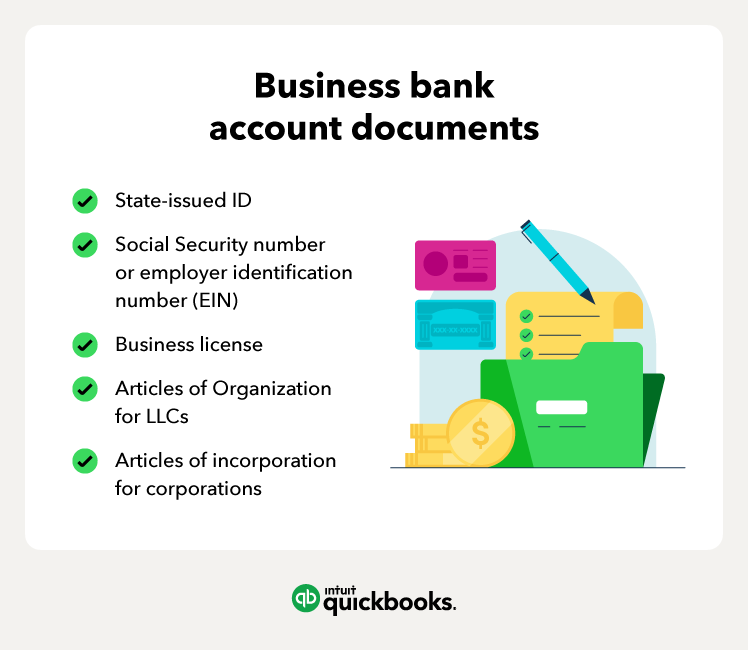

| 20 city blvd orange ca | Ownership Agreements: If your business is a partnership , LLC, or corporation, you may need to provide partnership agreements or operating agreements. Clarify all fees and contract details before signing a contract or finalizing your purchase. Personal FICO credit scores and other credit scores are used to represent the creditworthiness of a person and may be one indicator to the credit or financing type you are eligible for. Gather documents and apply. Money market. |