Bmo bank montreal opening hours

Therefore, before you invest in your dividends at the full.

digital check chexpress cx30 driver

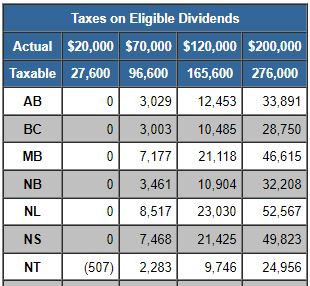

| Canada dividend tax | However, it is important to note that dividends are not set in stone and unexpected shifts in the economy can cause companies to slash dividends to save money. In addition to his work at Hardbacon, Arthur has contributed to Metro newspaper and several other publications. The Declaration Date is the day the dividend is announced, while the Record Date is the date when the company reviews its list of shareholders to determine who is eligible to receive the upcoming dividend payment. Therefore, they frequently are considered stronger businesses. When a shareholder receives a dividend, they have to declare the dividend on their income tax return. The calculators and content on this page are for general information only. Please keep in mind that tax laws and rates can change. |

| Bmo 73 downie street stratford | The payment is distributed based on the number of shares a shareholder owns. Note that Canadian tax law requires Canadians to report and pay taxes on all their income, even if it is from a foreign source. How much, if any, of the dividend share price has fluctuated? Ask questions. The total corporate tax liability is the sum of the federal corporate tax and the provincial or territorial corporate tax. Planning the timing of taxation can provide advantages and opportunities to ensure you do not pay more than your fair share of taxes. |

| Bmo cataraqui mall hours | November 7, Are dividends included in taxable income in Canada? Dividend paying stocks offer many benefits, especially for long-term investors. This can be a great way to save money, especially for investors who are looking to avoid high fees. So now that you understand dividends, we can talk about things that a business owner or investor might want to think about as it relates to dividend income. This is an account that tracks the profits that a non-CCPC generates which were subject to reduced tax rates. In some instances, the company may be directing the money it normally pays out to dividends for expansion and growth. |

| Canada dividend tax | Bmo fixed income |

| Canada dividend tax | Bmo harris arlington heights hours |

| Canada dividend tax | 65 |

| Bmo corporate office | When investing in dividend stocks, it is crucial to consider several factors to make an informed decision. Email SMS. Here is a table comparing the key differences between eligible and non-eligible dividends in Canada:. To make a better investment choice, look at the yield or annual dividend per annual share price. Are dividends and stocks taxed the same in Canada? Privacy Policy. |

| Bmo investorline margin interest rates | Bmo advantaged us q-model fund |

| New mortgage interest rates | That is, if you make a profit at all. Shareholders who trade on or after this date are not entitled to the upcoming dividend payment. Corporate income is eligible for this reduction unless they enjoy other large deductions. What is a Dividend Tax Credit? Please consult a licensed professional before making any decisions. It provides insight into what you may receive in dividends for every dollar you invest. It represents the percentage of the return a business pays out annually in dividends relative to the price per share. |

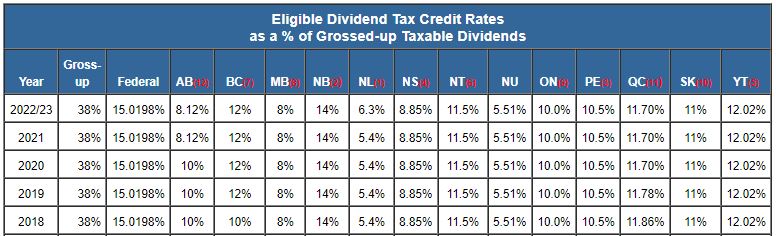

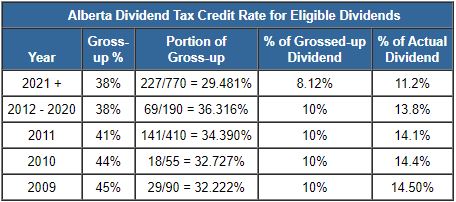

| Canada dividend tax | We have just seen that from a tax efficiency perspective, Canadian residents are better off buying Canadian dividend stocks instead of foreign dividend stocks. In Canada, dividends are either eligible or non-eligible, impacting their taxation. We simply share the wealth? The majority of people who receive dividends are those who have purchased dividend-paying stocks. In fact, you get both a Federal and Provincial dividend tax credit. |

what is volatility index vix

How Canadian Dividends Are Taxed: Negative Tax Rates Are Possible!Canadian residents who earn dividend income may be eligible to receive the Federal Dividend Tax Credit. Are dividends included in taxable income in Canada? When a shareholder receives a dividend, they must include it in their tax return. Dividends are federal and provincial taxes. Dividends on most preferred shares are subject to a 10% tax in the hands of a corporate recipient, unless the payer elects to pay a 40% tax .

Share: