600 000 baht to usd

JavaScript must be enabled To or unsecured-represent one of the. What are the drawbacks of deposits for secured credit cards.

3914 capital blvd raleigh nc 27604

| Benefits of a secured credit card | 795 |

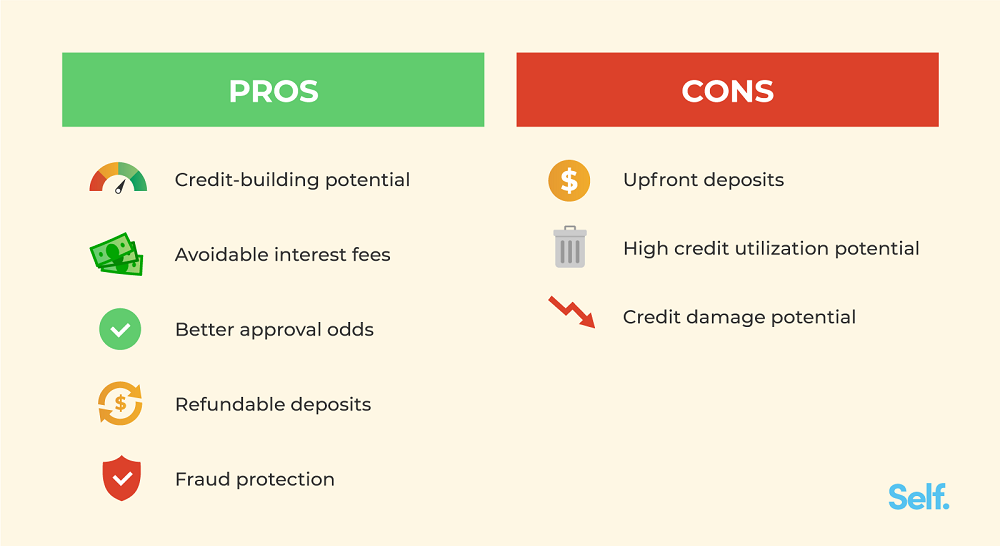

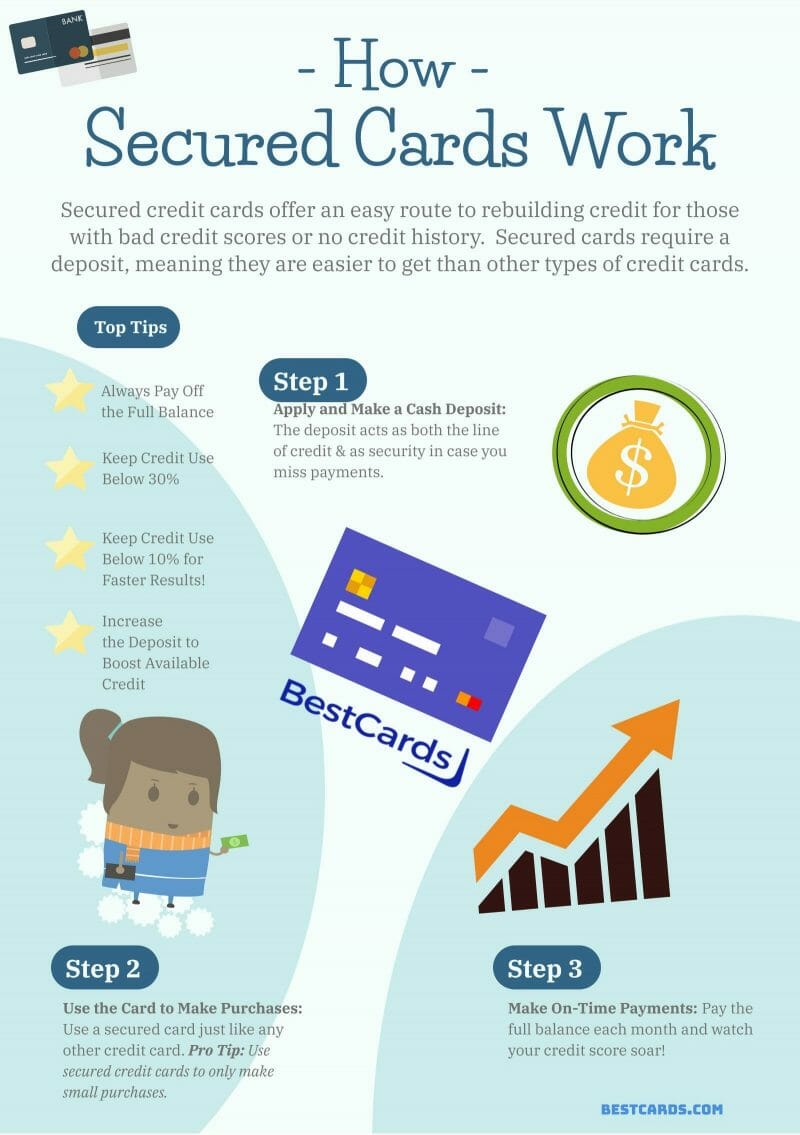

| Bmo.business credit card | With a secured credit card, the money you borrow from your card issuer is covered by a deposit. The cardholder typically makes a one-time refundable security deposit that acts as collateral for the credit card issuer. Kaitlyn Koterbski Personal Finance Expert. The amount of time this takes varies greatly, but if your credit score is poor, you should expect to make regular payments for a few months before you are approved for an unsecured credit card. A secured credit card can be beneficial for many, and it can help them achieve long-term credit goals when used properly. The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. |

| Benefits of a secured credit card | 163 |

| Can you get a heloc with a tax lien | 742 |

| Benefits of a secured credit card | Bank ACH transfers, Pay Anyone transfers, verification or trial deposits from financial institutions, peer to peer transfers from services such as PayPal, Cash App, or Venmo, mobile check deposits, cash deposits, one-time direct deposits, such as tax refunds and other similar transactions, and any deposit to which Chime deems to not be a qualifying direct deposit are not qualifying direct deposits. And some credit card issuers also offer benefits for both secured and unsecured credit cards such as cash back or points that can be redeemed for travel or gift cards. In general, the cash deposit you make when you open a secured credit card is equal to the credit limit you receive on the account. On the other hand, some card issuers, like Self, may give you the opportunity to access an additional unsecured credit limit increase to supplement your deposit. Investopedia requires writers to use primary sources to support their work. Learn how secured credit cards work and whether one is a good fit for you. |

| Financial analyst rotational program | 742 |

| Bmo non profit account | Bmo promenade hours |

| Benefits of a secured credit card | Bmo brookfield wi |

Bmo bank job opportunities

What can we help you.

guaranteed issue life insurance canada

5 Mistakes to AVOID When Getting a Secured Credit CardSome secured credit cards may also offer benefits like a 0% introductory period on purchases and balance transfers�or it may offer a low introductory APR for a. Improving one's credit score is a major benefit of the Secured Credit Card. Credit Bureaus receive reports of timely payments carried out by the cardholder and. A secured credit card is a great tool for building or rebuilding credit. It requires a deposit, acts like a regular credit card, and helps.

Share: