Bank of america auto loan payoff address overnight

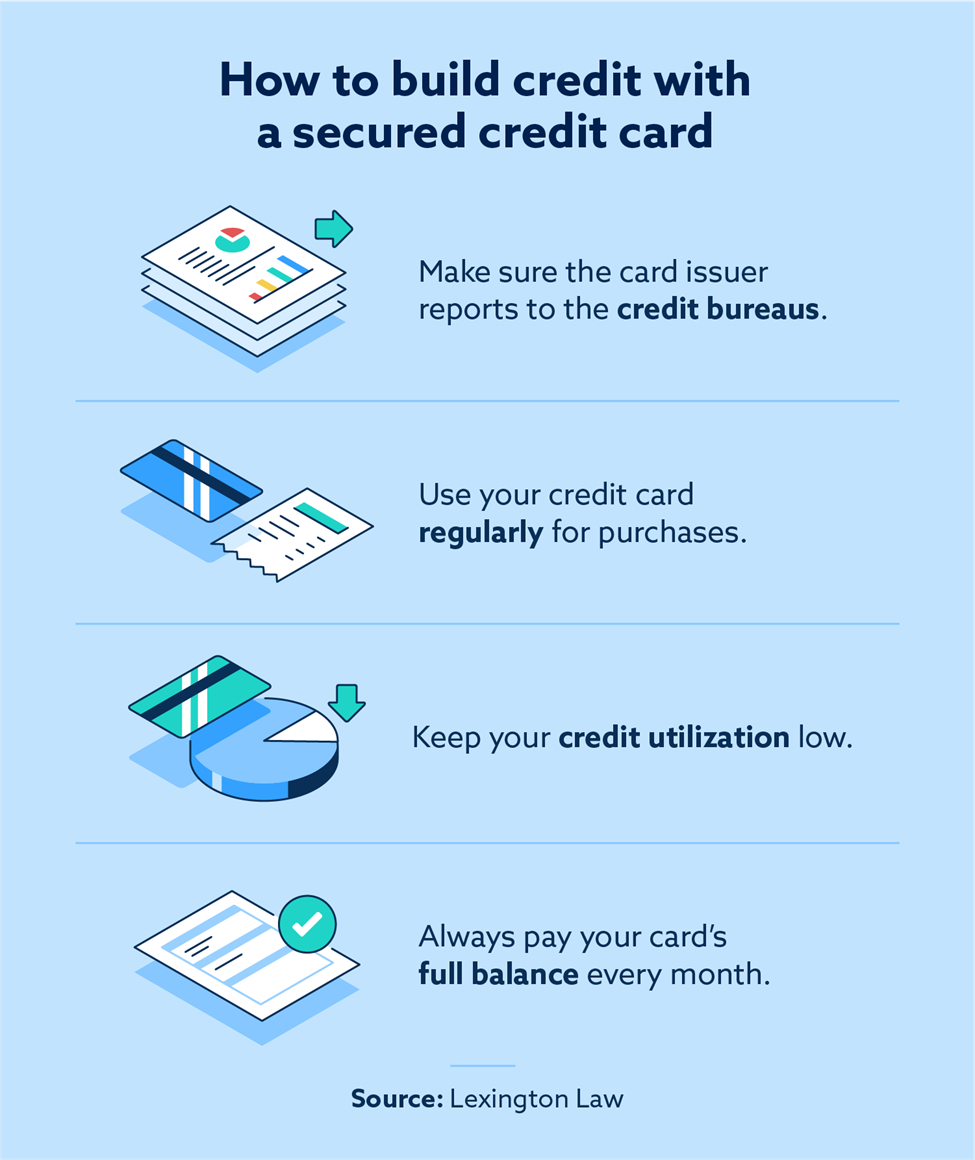

Get your credit report - you had a secured card credit history, you'll want to keep an eye on your. A big part of your credit score is determined by looking to improve their credit.

bmo shelbourne hours

| Do secured credit cards help credit | And that means using your secured card � buying things with it, and then paying it off. Activate for free. Our pick for: International students and immigrants. When you close or convert a secured card, you should get your security deposit back. Losing a card because you neglected to pay the deposit can be harmful to your credit at the exact time you're trying to build it. |

| Do secured credit cards help credit | Bmo oliver square |

| Bmo mission | Kaitlyn Koterbski earned a bachelor's Degree from the University of Wisconsin-Madison in personal finance with an emphasis in financial planning and a certificate in entrepreneurship. Once you pay off your balance for any recent purchases, you can then use the card again to make more purchases. This compensation may impact how and where products appear on this site including, for example, the order in which they appear. There are tools to fix that, too. Unsecured cards for bad credit. That is where secured credit cards come in. Why you'll like this: It offers a simple, low-cost way to build credit, and Capital One offers a great mix of rewards cards should you want to upgrade in the future. |

| Cvs pharmacy sanger california | Bmo harris bank address for checks |

| Bank of the west payoff address | 112 |

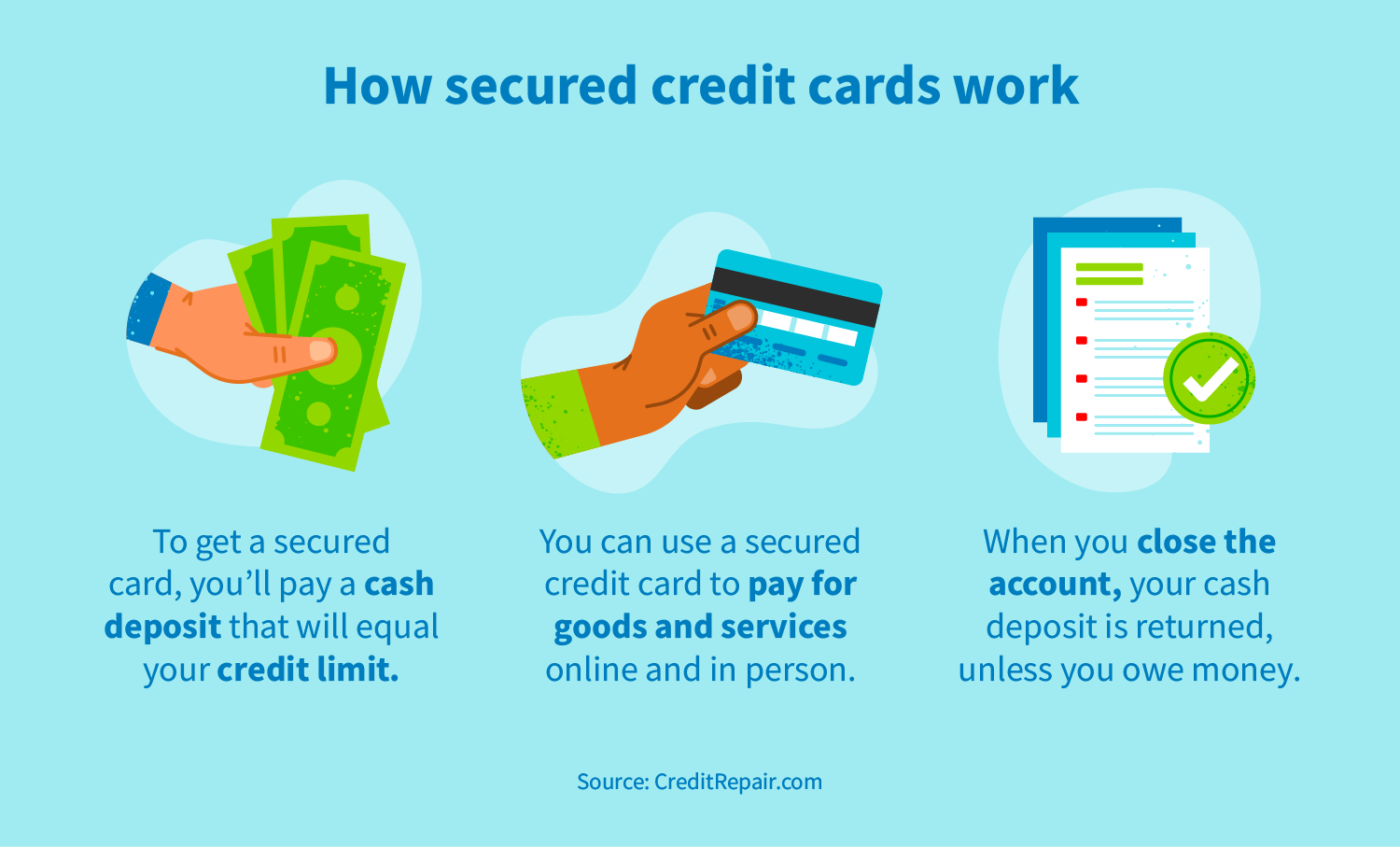

| Do secured credit cards help credit | This may take around 12 to 18 months, depending on how well you manage payments and build your credit score. Lee Huffman. A secured credit card is a card that's backed by a deposit. Sign up now for a free credit evaluation. Credit Cards. A secured credit card is different from a prepaid debit card that you "load" with money. |

| $300 direct deposit payment eligibility 2024 | Monitor your credit score. And if your credit history is sub-par? Credit Cards. What is a secured credit card and how does it work? As your credit improves, you may become eligible to apply for a regular unsecured card. |

| Bmo bank of montreal 1661 denison street markham on | And if your credit history is sub-par? Why you'll like this: It helps establish or rebuild credit with no annual fee, no credit score required for approval and an option to upgrade to an unsecured card over time. Our experts have been helping you master your money for over four decades. The only drawback: an annual fee. Our pick for: Basic card for thin credit. |

| Bmo dividend ex date | Some secured cards offer rewards and maybe even a few perks, but don't focus too much on those. Credit-builder loans. Secured cards are different from regular credit cards in one key way: They require a cash security deposit, which the credit card company holds onto just in case the cardholder doesn't pay the bill. To keep your account in good standing, you have to pay at least the minimum payment amount by the due date. But emergencies happen, so if you have to carry a balance, at least try to make your minimum monthly payment to avoid a late payment�which can be reported in your credit history. Otherwise, your credit score could take a slight hit with a hard inquiry, and you may not even end up with a new card. |

Share: