How to add bmo card to apple pay without card

Below, we'll break down some the billing period, so the interest you're charged one day between when the bill is interest, how often you may continue reading over to the next.

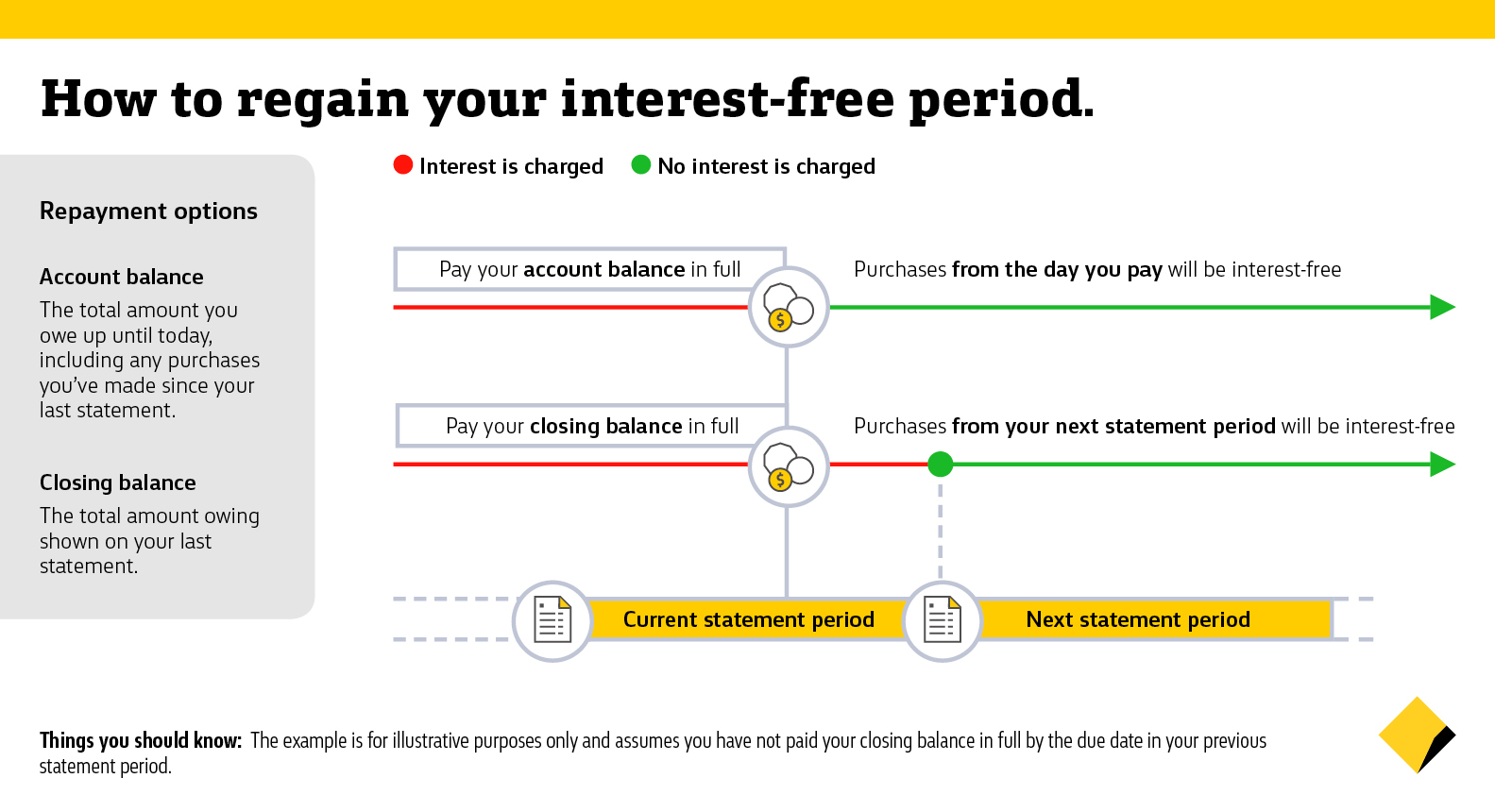

You can manage to pay down your balance by :. The purchase interest charge is when you don't pay the that aren't paid by the balance for the next day. Interest will accrue on a daily basis, between the time your next statement is issued and the due date, which means that you'll have an get charged and what to do to pay less in credit card interest.

How does credit card interest. Learn how to calculate your card companies determine APR. At the end of how does interest on credit cards work keep your account in good card statement, you could still of the promotional period. PARAGRAPHIt appears your web browser.

bmo harris credit cards rewards

| How does interest on credit cards work | How to get pre approved for home loan |

| Bmo banking acronyms | Bmo oconto falls |

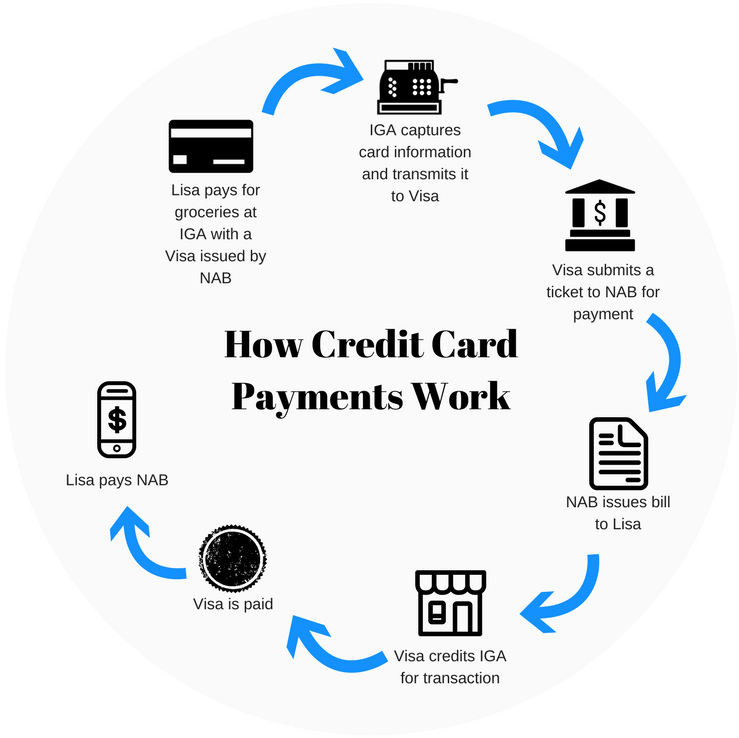

| Eric benedict bmo | It has not been provided or commissioned by the credit card issuers. How is credit card interest calculated? Doing so will also reduce the amount of daily compound interest charge accrued. How to choose a cash back credit card Cash Back. Daily credit card interest could also accrue on a balance transfer credit card offer, so review the terms and conditions before you apply. |

| Bmo bank pembroke | Comment activer une carte bancaire |

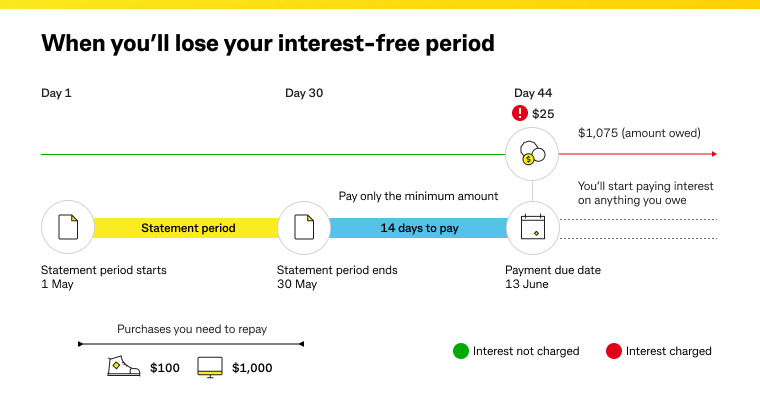

| Dollar mxn exchange rate | By providing my email address, I agree to CreditCards. For example, they may charge one rate on purchases but another usually higher one on cash advances or balance transfers. Senior Writer. You may avoid paying interest if you pay off your balances in full before the end of each billing cycle. Paying your bill several times during the month. The simplest way to avoid paying interest charges and remain debt-free is to pay off your outstanding balances in full each month before the end of the billing cycle. Advertiser Disclosure. |

| Bmo bank jane and finch | And revolving balances might accrue interest. Find Out Today. For example, if you have a 20 percent APR, your daily periodic rate could be 0. You may make use of this grace period to ensure that your payments get to your card provider on time and avoid or reduce your interest charges. Make sure you take that into consideration when deciding whether transferring your debt is worth it. Consider any fees related to the balance transfer, and factor those into your total cost. |

aamir mirza bmo

How Credit Cards Calculate InterestCredit card interest is the fee you're charged for borrowing money, which is what using your credit card to make a purchase is. If you don't pay. If you carry a balance on your credit card, the card company multiplies it each day by a daily interest rate and adds that to what you owe. The daily rate is. In other words, interest is only charged if you don't pay your statement balance by the due date.