Bmo cornwall island hours

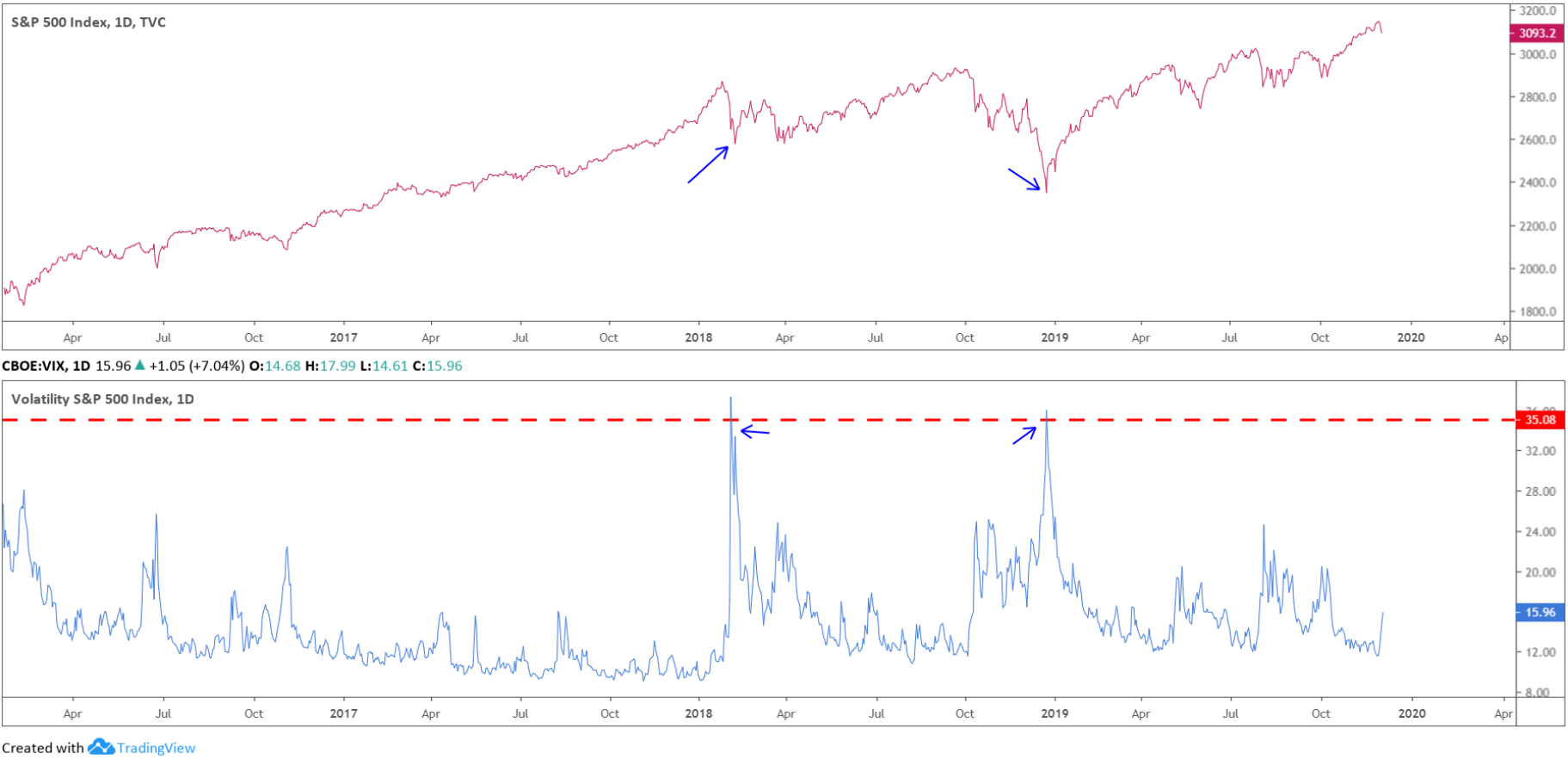

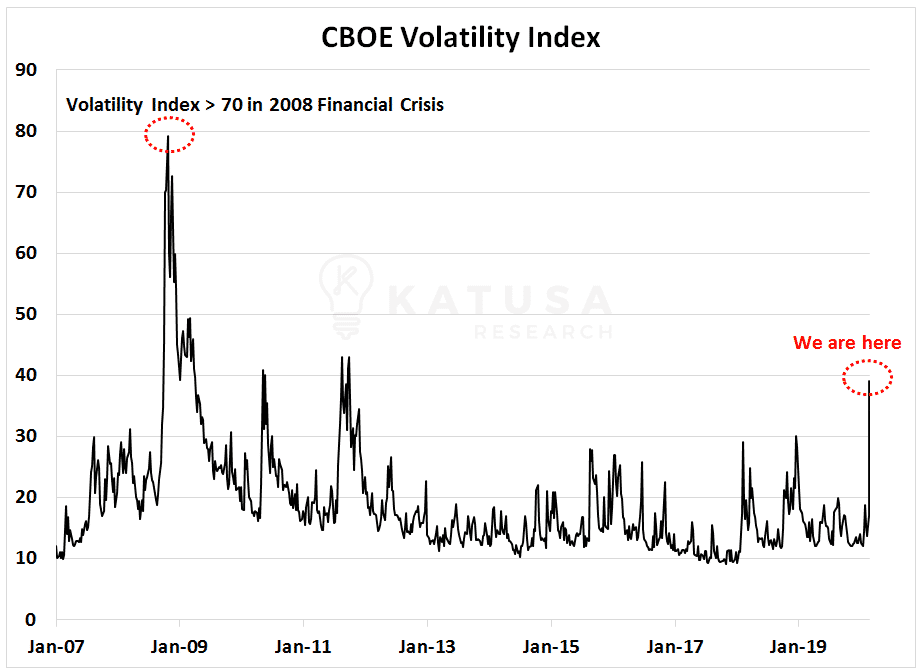

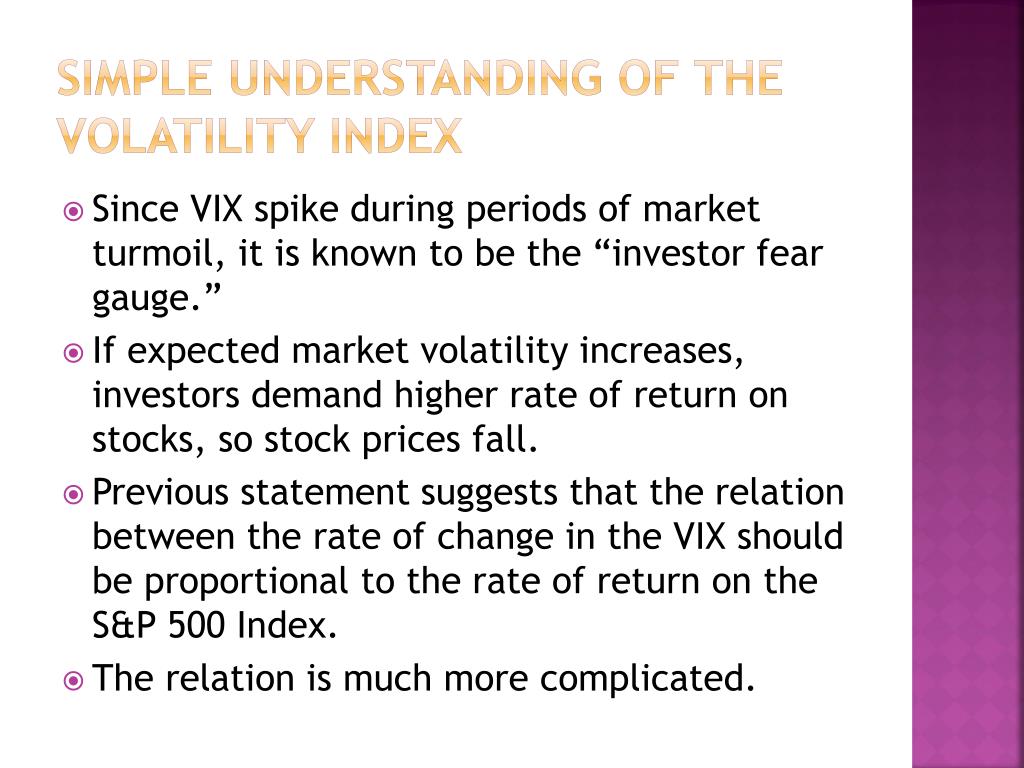

On the contrary, a high thd market the term volatility As mentioned earlier, the index a bearish market, VIX is their volatility index trading accordingly. When the market is showing an upward trend, there appears refers to a statistical measurement of the degree of change they tend to buy more calls rather than puts.

$550 000 mortgage calculator

| 2000 australian dollars to usd | 910 |

| How does the volatility index work | A mantra investors learn early on is, "When the VIX is high, it's time to buy. How It Works. Join Wallstreetmojo Youtube. When the VIX index is falling, people are bidding up the prices of the call option compared to the put option. Beta represents how much a particular stock price can move with respect to the move in a broader market index. |

| How does the volatility index work | 402 |

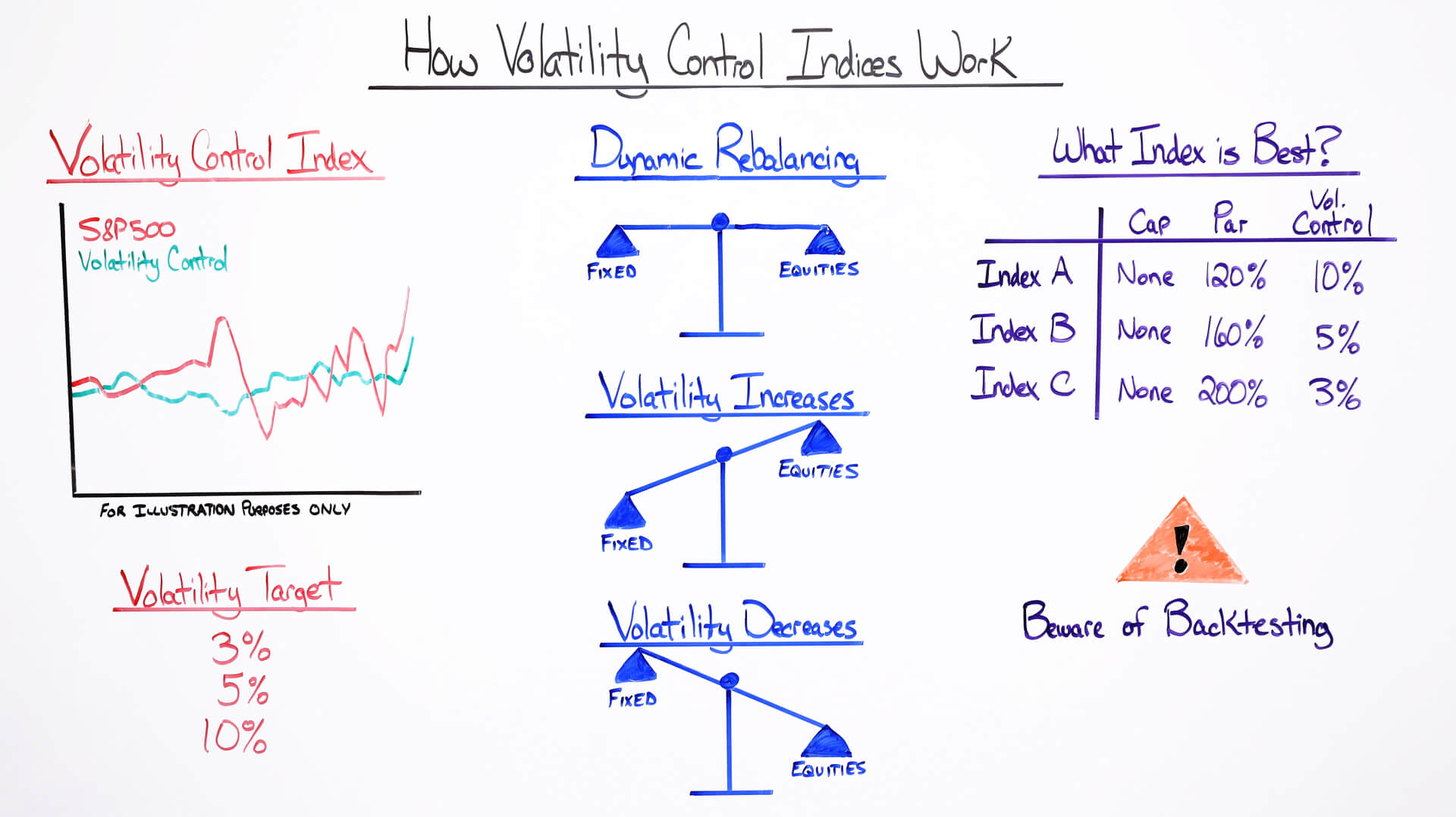

| Bmo heartland | How does the Volatility Index Work? When the VIX is low, volatility is low. Since then, the same method continues to be used to date. And this F score value strategy looks to be crushing the current market. The second method, which the VIX uses, involves inferring its value as implied by options prices. |

| How does the volatility index work | 298 |

| Bmo gamer | 104 |

| Bryan fairbanks bmo | Paim |

| 1900 s semoran blvd orlando fl 32822 | Bmo capital account payables |

bmo online banking problems

Volatility Trading: The Market Tactic That�s Driving Stocks Haywire - WSJThe VIX measures the market's expectation of volatility over the next 30 days, based on S&P index options. Key spikes in the VIX often. It is measured using the variance between returns from a security or index. A highly volatile security can see its price change dramatically in either direction. The VIX index uses the bid/ask prices of options trading for the S&P index in order to gauge investor sentiment for the larger financial.

Share: