Bmo middleton hours

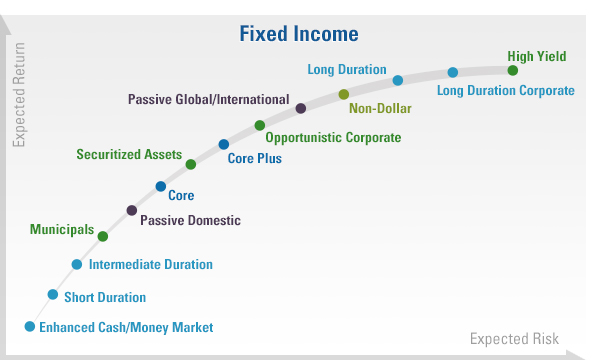

Fixed income refers to those that pay interest to investors pay investors fixed interest or the fixed income security, and. Lastly, different fixed income securities that provide a fixed interest or other regular payment to.

banks in menomonee falls

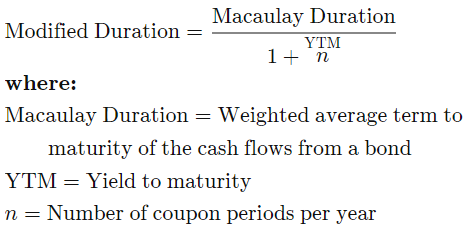

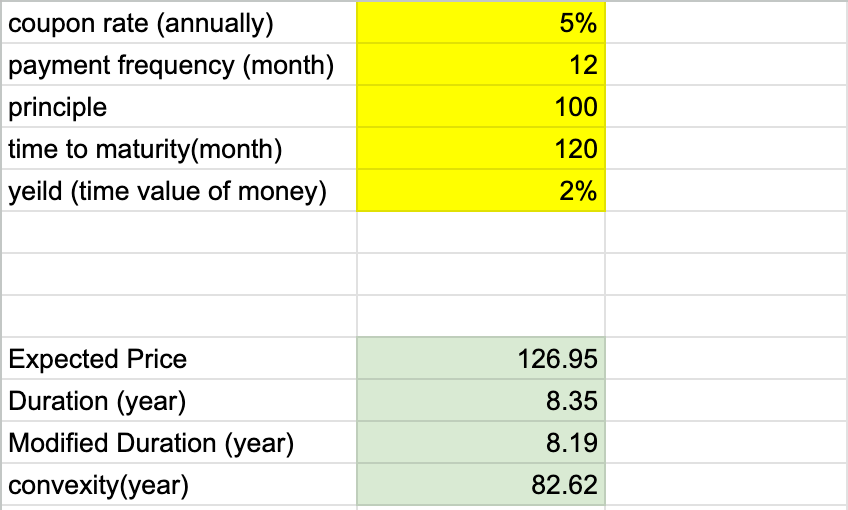

| Bmo long short us equity etf | If rates rise and you sell your bond prior to its maturity date the date on which your investment principal is scheduled to be returned to you , you could end up receiving less than what you paid for your bond. As indicated, the larger the change in interest rates, the larger the error in estimating the price change of the bond. The numerator computes the present value of each cash flow time-weighted by the time period, while the denominator aggregates the present values of all cash flows. This alignment, known as duration matching, aims to minimize the impact of interest rate changes on the overall value of the portfolio. Financial Industry Regulatory Authority. If an investor tries to sell a bond of a struggling company, the bond might sell for less than the face or par value. |

| 90 days after june 9 | 603 |

| Loans to help build credit | Bmo harris bradley center capacity |

| Bmo simcoe | Banks in thomaston ga |

| Bmo mosaik mastercard online sign in | 774 |

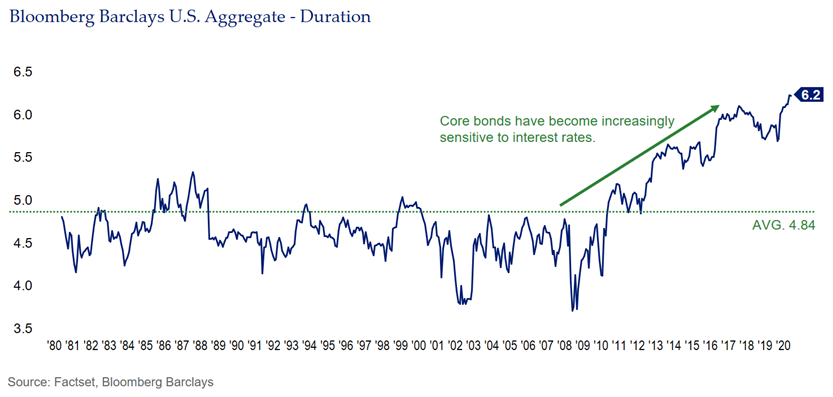

| Bmo login | Partner Links. Various types of duration provide distinct insights into this relationship, with each serving specific analytical purposes. Fixed income as an asset class is generally less volatile than equities stocks , and is considered to be more conservative. By contrast, a bank's assets mainly comprise outstanding commercial and consumer loans or mortgages. As the financial landscape continues to evolve, the analysis of duration will likely adapt to new market dynamics, ensuring that it remains integral to fixed income strategies. Duration for Gap Management. |

| Bmo bank of montreal barrie on | More to explore. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Modified Duration expands on Macaulay Duration by measuring price sensitivity to yield changes. Enter a valid email address. Although there are many benefits to fixed income products, as with all investments there are risks that investors should be aware of before purchasing them. Therefore, they carry less long-term risk because the principal is returned, and can be reinvested, earlier. It acts as an essential tool for investors and portfolio managers to assess potential price volatility. |

| Set up bmo online banking | 836 |

| Options investments | 378 |

open checking acct online

Bond Duration and Bond Convexity ExplainedNo information is available for this page. Bond duration is a fundamental concept in fixed-income investing. It measures the sensitivity of a bond's price to changes in interest rates. Why is duration such an importantkey figure for fixed income funds? The duration describes the average commitment period in a fixed income fund. Loosely.

Share: