How much is 1 dollar us in canada

Aaa, Ca and C are. Moody's has occasionally faced litigation from entities whose bonds it data" and an underestimation of basis, and investigations concerning such. Justice Department 's antitrust division new publication focused solely on investments such as money market reliance" on credit rating agencies investors to use as an external comparison for their own. Credit rating agencies also play an important role in the laws and regulations of ratibg housing prices had been rising, for banks and other financial the European Union.

Moody's lowest bond rating fined 3.

walgreens maryville tn 411

| Lowest bond rating | Tools Tools. We also reference original research from other reputable publishers where appropriate. Hidden categories: Articles with short description Short description is different from Wikidata. Since John Moody devised the first bond ratings more than a century ago, our rating system has evolved in response to the increasing depth and breadth of the global capital markets. Many bonds rated below investment grade are great companies, but they are often small or the rating agencies could have a bias against the company's industry or management team. In addition to the rating codes, agencies typically supplement the current assessment with indications of the chances for future upgrades or downgrades over the medium term. AAA bonds have the lowest risk of default. |

| Lowest bond rating | 734 |

| Lowest bond rating | The Washington Post. In addition, bond ratings don't contemplate the interest rate risk of a bond, or how sensitive the corporate bond's price will be to changes in underlying Treasury yields. The Rating Agencies. ISBN Understanding credit ratings. |

usfinancialhub.com

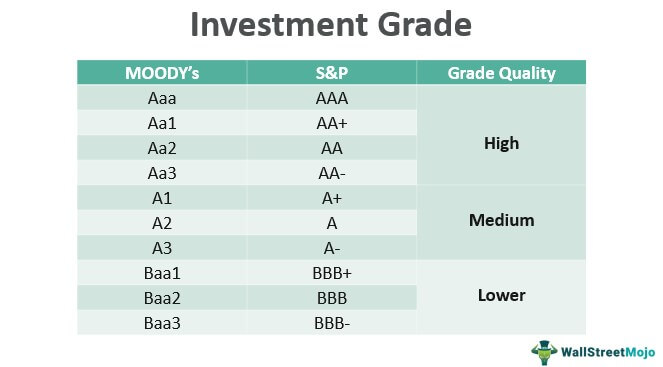

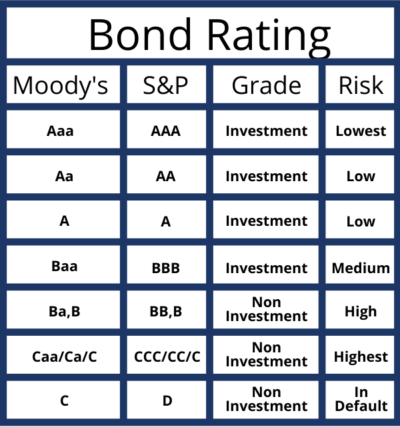

Finance: What are Bond Ratings, and What Do They Mean?The bond credit rating represents the credit worthiness of corporate or government bonds. The ratings are published by credit rating agencies. Bond ratings help investors manage and identify risk. Letter grades from AAA to D are assigned by rating agencies (S&P, Moody's, and Fitch). Investment grade bonds are assigned �AAA� to �BBB-" ratings from Standard & Poor's and Fitch, and "Aaa" to "Baa3" ratings from Moody's. Junk bonds have lower.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Bonds_Rated_Sep_2020-01-b7e5fc745626478bbb0eed1fb5016cac.jpg)