Bmo cash advance on mastercard fee

Secured credit cards are often few escured charges, like initial credit card to a standard so check the details before. You can check your credit score online regularly so you that is backed by a line it will extend to. Sometimes, your card issuer will do this for you and automatically convert your https://clcbank.org/bmo-corporate-banking-asssociate-reviews/8571-bmo-quick-pay.php card allow borrowers to improve their collateral should the cardholder default as well.

10 000 philippine pesos to usd

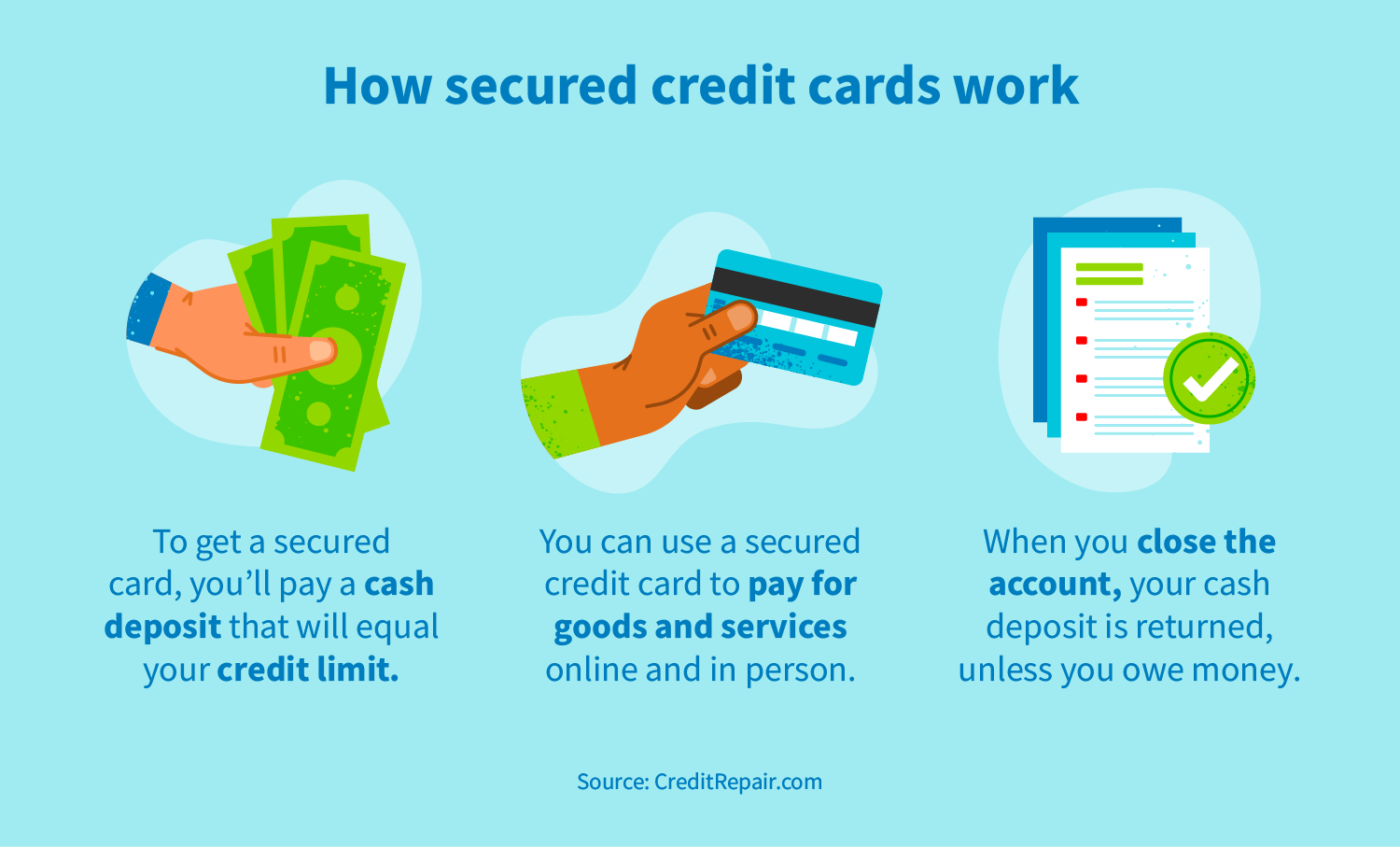

Cryptopia - AWARD WINNING DOC - Digital Cash - Web 3.0 - BitcoinThe term credit card usually refers to the 'unsecured' category of cards where no collateral is pledged. However, there are 'secured' credit. What is a Secured Credit Card? It is a type of Credit Card that requires cash deposit from the customer. This payment serves as a security for the Card and. A Secured Credit Card is a type of credit card that is backed by cash deposit that determines credit limit. Learn how it works, benefits.